What's a HELOC?

A home equity line of credit, or HELOC, is a type of loan that uses real estate as collateral and which allows you to receive a cash payment advance against the equity of your home or property.

Similar to how a credit card works, with a HELOC you’ll have a variable interest rate and monthly payment that fluctuates based on current prime rate and how much money was borrowed. However, unlike a credit card your monthly HELOC loan payment may be based on an amortized schedule of between 7-30 years.

HELOCs will usually have lower interest rates than personal loans and other home equity loans – but this depends on the details of the borrower. Like other loan products, a higher credit score, a lower debt-to-income ratio and a good amount of equity in your home will help you get an optimal rate for a Florida Home Equity Line of Credit (HELOC).

Because of this, HELOCs are ideal for people in Florida who need funds for debt consolidation, home improvement projects or who want to use their cash equity for personal purchases rather than take on new debt financing.

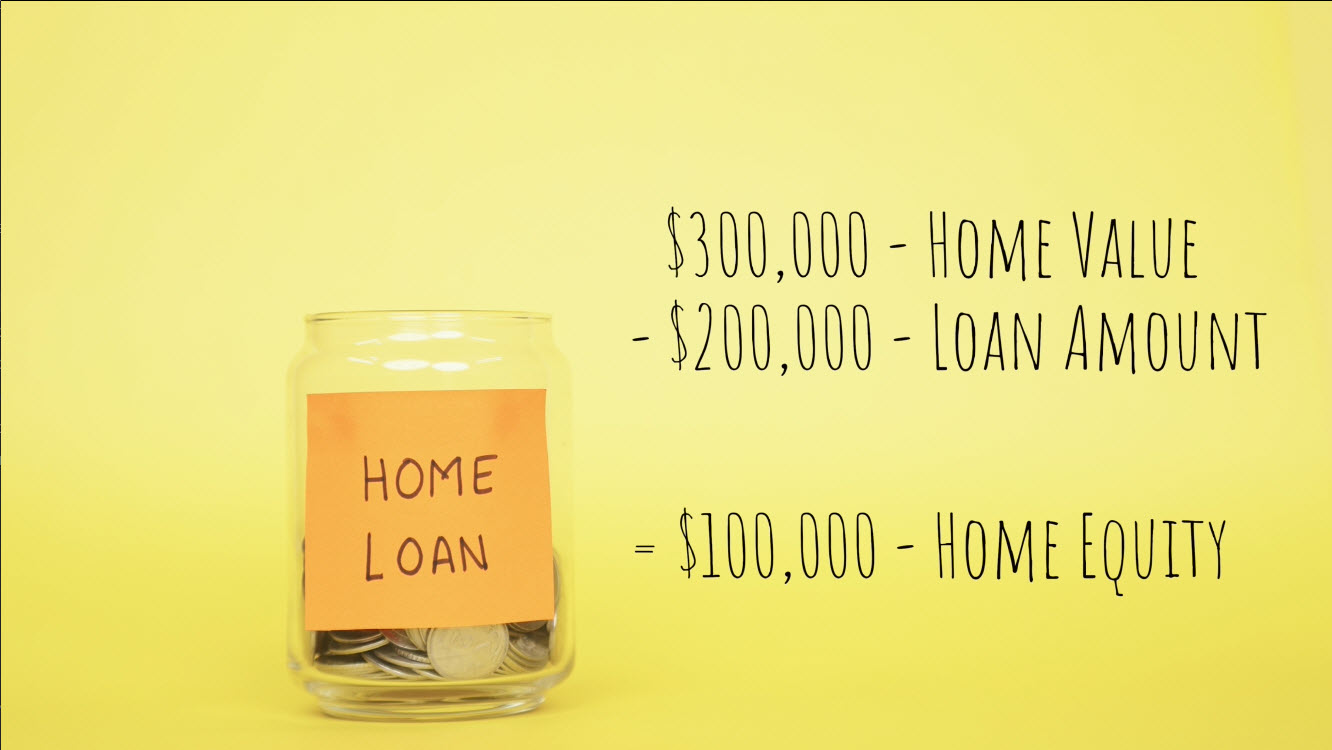

What's a Home Equity Loan?

A home equity loan is a type of second mortgage that allows homeowners to borrow against the equity in their home. The loan amount is provided in a lump sum and is repaid over a fixed term at a fixed interest rate.

The general approval process for a home equity loan involves an appraisal of your home to determine its current market value. Lenders typically allow you to borrow up to 85% of your home’s value, minus any existing mortgage balance.

Choosing between a home equity loan and a HELOC largely depends on your financial needs and circumstances. If you need a large sum of money for a one-time expense and prefer predictable monthly payments, a home equity loan might be the better choice.

Conversely, if you need ongoing access to funds and are comfortable with variable interest rates, a HELOC might be more suitable. It’s particularly useful for expenses that occur over time, such as tuition fees or home renovation projects spread over several months.

When Should You Consider Using Home Equity

Debt Consolidation

Use a HELOC or Home Equity Loan to pay off high interest debt like credit cards or personal loans. This can save you money on interest payments and help you get out of debt faster.

Home Improvement

Use a HELOC or Home Equity Loan to finance repairs, renovations or additions to your home. This can add value to your property and make it more comfortable to live in.

Personal Use

Use a HELOC or Home Equity Loan for things like medical bills, tuition or other large purchases. This can help you avoid going into debt or using high interest credit cards.

Home Refinancing

Use a HELOC or Home Equity Loan to access your earned home equity instead of refinancing your current low interest rate mortgage to one with a higher interest rate.

Benefits of using Home Equity

FIVE key benefits of getting a HELOC or Home Equity Loan with The Wholesale Mortgage Firm

Faster Access to Cash

Using Home Equity will typically close faster than a home refinance - meaning you'll have faster access to your loan funds.

Use Your Equity

Home Equity funds typically offer the ability to access your accumulated home equity in the form of a cash payment.

Keep Your Low Rate

HELOC's & Home Equity loans are independent of your primary mortgage - allowing you to keep your original interest rate.

Borrow What You Need

Using Home Equity affords you the ability to choose the exact amount you want to borrower from your availble equity.

Lower Closing Costs

A HELOC or Home Equity loan will usually have less fees and less overall closing costs than that of a home refinance loan.

Refinance, HELOC Or Home Equity Loan?

Florida HELOC’s and Home Equity Loans offer many benefits but it’s important to understand the risks before taking one out. As with any loan, you’ll be responsible for repaying the HELOC / Home Equity Loan plus interest and fees. If you don’t make your payments on time, you could lose your home to foreclosure. Additionally, if the value of your home decreases, you could end up owing more than your home is worth.

Before taking out a HELOC or Home Equity Loan, make sure you understand the terms and conditions and are comfortable with the risks. It’s also a good idea to speak with a financial advisor and a mortgage loan officer at The Wholesale Mortgage Firm to get expert advice on whether a HELOC is right for you.

To learn more about HELOC's, Home Equity Loans and Refinancing Your Home, read our comparison guide here.

Popular Articles

The Top 8 Ideas to Make the Best Use of Home Equity

In this blog post, we’ll explore eight creative ideas for using home equity to help you achieve financial goals and improve your life.

Compare HELOC, Second Mortgages & Refinances – Pros and Cons

In this blog post, we’ll dive deep into the pros and cons of refinancing vs HELOCS and second mortgages, explore interest rates and costs, and discuss the qualification requirements and approval processes.

Compare HELOC Vs Home Equity Loans: Pros and Cons

Dive into our informative blog post comparing HELOCs and Home Equity Loans. Understand the pros, cons, and key differences to make smart financial decisions. Empower yourself with knowledge today!